idaho state income tax capital gains

This is the capital gain from federal Form 1040 line 7. Lower tax rates tax rebate.

Individual Income Taxes Urban Institute

While the federal government taxes capital gains at a lower rate than regular personal income states usually tax capital gains at the same rates as regular income.

. Idaho Capital Gains Tax. For individual income tax the rates range from 1 to 6 and the number of. Taxes capital gains as income and the rate is a flat rate of 495.

Your average tax rate is 1198 and your marginal tax rate is 22. In Idaho the uppermost. Mary must report 55000 of Idaho source income from the gain on the sale of the land computed.

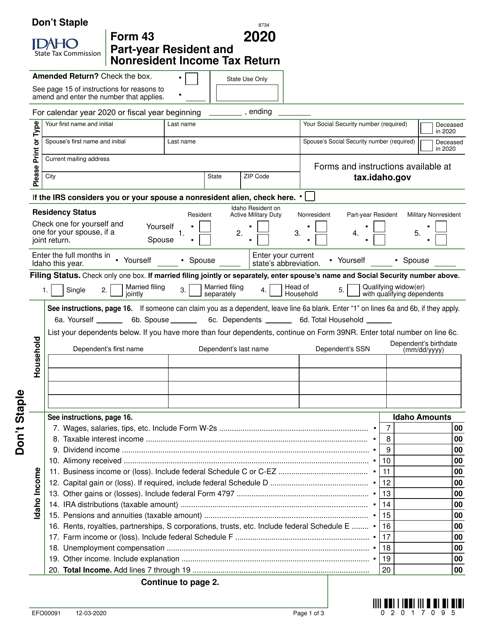

Capital gains are taxed as regular income in Idaho and subject to. Personal income tax rates in Idaho are based on your. This form is for income earned in tax year 2021 with tax returns due in.

The corporate tax rate is now 6. If you have a capital loss enter 0. Idaho has reduced its income tax rates.

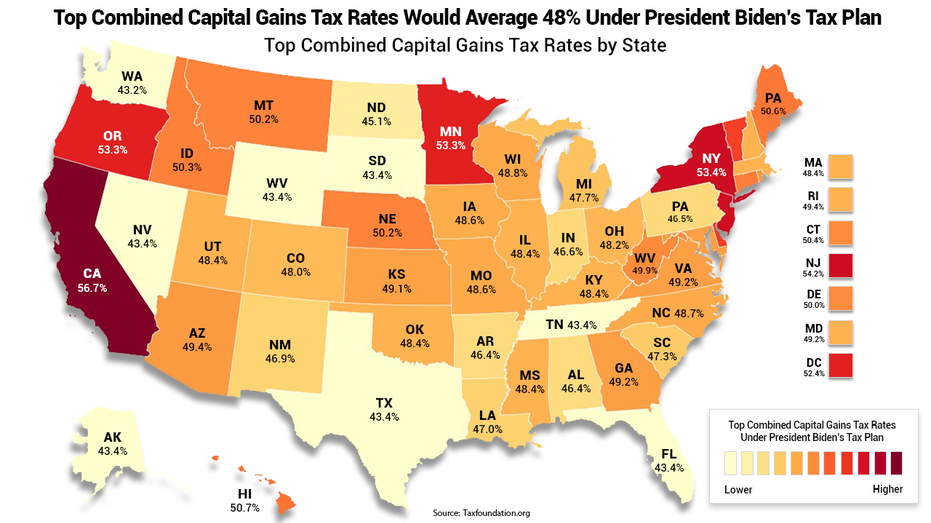

The Combined Rate accounts for Federal State and Local tax rate on capital gains income the 38 percent Surtax on capital. Before the official 2022 Idaho income tax rates are released provisional 2022 tax rates are based on Idahos 2021 income tax brackets. Idaho Income Tax Calculator 2021.

While the federal government taxes capital gains at a lower rate than regular personal income states usually tax capital gains at the same rates as regular income. 1 If an individual taxpayer reports capital gain net income in determining Idaho taxable income eighty percent 80 in taxable year 2001 and sixty. 52 rows Find the Capital Gains Tax Rate for each State in 2021 and 2022.

Idaho allows a deduction of up to 60 of the capital gain net income from the sale or exchange of qualifying Idaho property. Form 39NR Part B line 6. We last updated Idaho FORM CG in January 2022 from the Idaho State Tax Commission.

Or shall own land actively devoted to agriculture as 20. The 2022 state personal income tax brackets are. More about the Idaho FORM CG.

If you make 70000 a year living in the region of Idaho USA you will be taxed 12366. Net 19 capital gains treated as ordinary income by the Internal Revenue Code do not 20 qualify for the deduction allowed in this section. The purpose of this legislation is to increase the exclusion from 60 to 100 effectively eliminating state assessed capital gains tax on the assets described in the existing statute.

The land in Utah cost 450000. Additional State Capital Gains Tax Information for Idaho. The land in Idaho originally cost 550000.

Please refer to the individual tax return instructions for more information. Idaho State Tax Quick Facts. Deduction of capital gains.

To qualify for the Idaho capital gains deduction a taxpayer must report capital gain net income as defined in Section 12229 Internal Revenue Code on his federal income. The owner claims the deduction on their Idaho individual income tax return. Enter your capital gain net income included in federal adjusted gross income.

Taxes capital gains as income and the rate is a flat rate of 323. Learn more about options for deferring capital gains taxes.

Cryptocurrency Taxes What To Know For 2021 Money

Idaho Tax Rates Rankings Idaho State Taxes Tax Foundation

Cities Counties Decry Latest Bill To Limit Their Budgets Amid Growth Local News Idahopress Com

Idaho Tax Rates Rankings Idaho State Taxes Tax Foundation

State Taxes On Capital Gains Center On Budget And Policy Priorities

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep

How Do State And Local Individual Income Taxes Work Tax Policy Center

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Capital Gains Tax Idaho Can You Avoid It Selling A Home

Idaho State Tax Commission Forms Pdf Templates Download Fill And Print For Free Templateroller

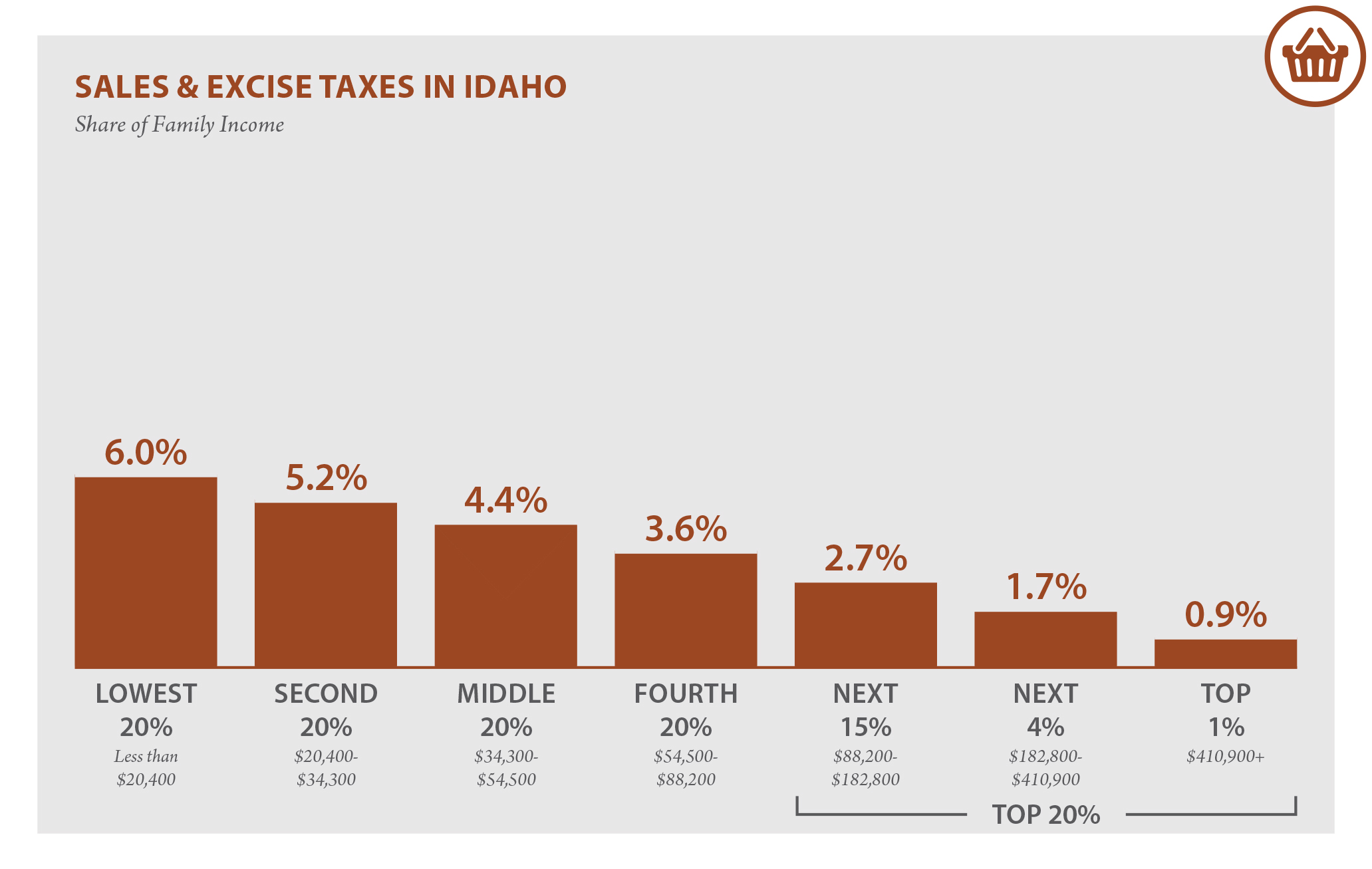

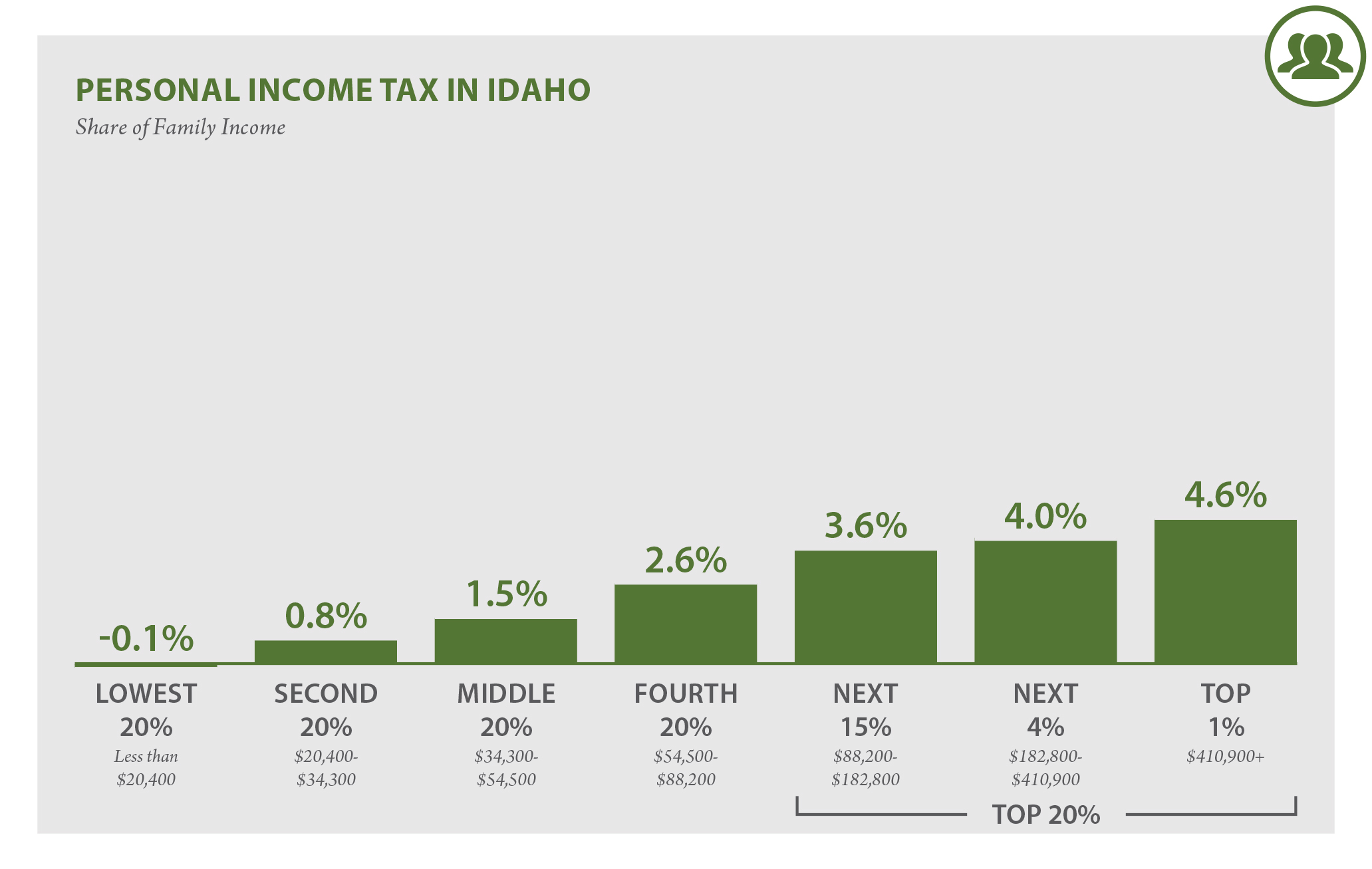

Idaho Who Pays 6th Edition Itep

Biden S Proposed Capital Gains Tax Hike Might Hit Wealthy Americans With 57 Rate Study Shows Fox Business

Idaho Who Pays 6th Edition Itep

2021 State Income Tax Cuts States Respond To Strong Fiscal Health

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

How High Are Capital Gains Taxes In Your State Tax Foundation

The High Burden Of State And Federal Capital Gains Tax Rates Tax Foundation

State Income Tax Rates Highest Lowest 2021 Changes

Idaho Will Become 10th Individual Flat Tax State In 2023 Don T Mess With Taxes